Sansone CPA & Financial:

Tax Efficient Financial Planning For S Corp Business Owners

CPA tax expertise and financial planning from a CFP® professional — specializing in S Corporations

-

Financial Planning

-

Tax Services

Based in Crystal Lake, Illinois

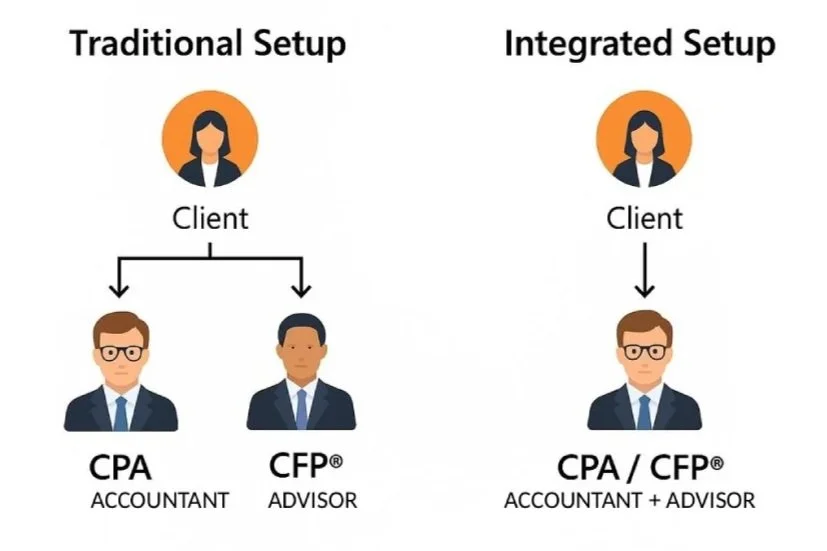

Build Wealth and Reduce Taxes Without Managing Multiple Advisors

If you're an S corporation owner making $500K–$5M in annual gross revenue, you’re probably overpaying in taxes, missing out on financial planning opportunities, or both, because your CPA and financial advisor aren’t talking to each other. We fix that.

At Sansone CPA & Financial, we manage both sides of your financial life, your taxes and your finances, so you’re not stuck coordinating between disconnected professionals who only see half the picture.

We typically work with S corporation business owners with businesses generating between $500,000 and $5 million in annual revenue, who often feel overwhelmed by the complexity of their tax and financial landscape. Many of these people rely on separate financial and tax advisors who don’t collaborate, resulting in missed tax-saving opportunities, conflicting strategies, and increased stress.

What We Do for Business Owners Like You

Our specialty is working with service-based S corporation business owners in industries like trades, real estate, health care, professional services, and agencies: business owners who are tired of reactive tax preparation and limited advice.

Instead, we:

Develop customized wealth strategies aligned with your business structure and financial goals

Open and manage investment accounts for you — including 401(k)s, Solo 401(k)s, SEP IRAs, SIMPLE IRAs, Roth IRAs, and other retirement or taxable accounts

Provide ongoing investment management for both your business and personal assets, consistent with fiduciary standards — similar to traditional financial advisory firms

Coordinate investment and tax planning to help align your portfolio with your cash flow and long-term goals

Deliver proactive tax strategies designed to reduce your overall liability across business and personal tax returns

Offer in-house bookkeeping services to support accurate financial records and integrated tax planning

On average, our clients may save $10,000–$20,000 in their first year by restructuring how they pay themselves, investing through their business by making tax deductible investment account contributions, and optimizing their business structure. Industries that we work with include:

Skilled Trades & Home Services

(Contractors, cleaners, landscapers, HVAC, etc.)

Real Estate & Property

(Agents, brokers, investors, landlords)

Health & Wellness Professionals

(Doctors, therapists, gym owners, chiropractors, med spas)

Professional & Business Services

(Lawyers, consultants, agencies, marketers)

Creative & Digital Entrepreneurs

(Coaches, online creators, tech freelancers, course sellers)

One Firm. One Strategy.

Most firms separate tax and financial planning, we combine them. Your portfolio rebalancing, retirement plan contributions, and business structure all impact your tax situation. We align every move to lower your tax bill and grow your wealth.

No guesswork. No handoffs.

If you're looking for a full-service, year-round partner for proactive tax and financial strategy, we can help.

Want to See What This Looks Like?

We offer a free consultation to review your situation, identify missed tax savings opportunities, and an overview of how to fix it.

Services

Wealth Management and Investment Advisory.

Tax Preparation, Tax Planning, and Tax Projections.

HOURS:

Regular Hours

Monday-Friday: 8:00 AM – 4:30 PM

Tax Season

February 1st – April 15th

Monday – Friday: 8:00 AM – 6:00 PM

Saturday: 8:00 AM – 12:00 PM